Europe’s industrial landscape, long considered the bedrock of its prosperity and geopolitical influence, has experienced a gradual but profound transformation. This process, often described as a “collapse” by observers, is a complex interplay of economic, technological, and social forces that have reshaped the continent’s productive capacity. While terms like “deindustrialization” have been used for decades, the current trajectory suggests a more systemic and potentially irreversible shift, impacting not only national economies but also the fabric of European society.

For centuries, European nations stood at the forefront of industrial innovation. From the textiles of the Industrial Revolution to the heavy machinery of the 20th century, European factories were the engines of global progress. However, this dominance has steadily eroded, akin to a once-mighty dam showing cracks under incessant pressure. The reasons for this decline are multifaceted, ranging from globalization to evolving market demands.

The Rise of Global Competition

The most significant factor contributing to the erosion of traditional manufacturing is undoubtedly the rise of global competition. Developing nations, particularly in Asia, have leveraged lower labor costs, nascent regulatory environments, and favorable government policies to establish dominant positions in various manufacturing sectors. This has led to a significant redirection of production capacity.

The reader might consider the textile industry as a prime example. Once a powerhouse in many European countries, textile production has largely migrated to countries with significantly lower overheads. This shift, while economically rational for corporations seeking greater profitability, has left a void in regions that once thrived on these industries, leading to job losses and diminished local economies. Similarly, the electronics and consumer goods sectors have seen a dramatic pivot towards Asian manufacturing hubs, leaving European companies to focus on niche markets or higher-value components.

Automation and Technological Displacement

Beyond international competition, the relentless march of automation and technological advancement has played a crucial role in reshaping European industrial output. While technology can enhance efficiency and productivity, it also reduces the demand for manual labor, a phenomenon often referred to as technological displacement.

The automotive industry, a cornerstone of several European economies, exemplifies this trend. While production volumes may remain high, the number of human hands required on the assembly line has drastically decreased due to robotic automation. This efficiency, while beneficial for corporate balance sheets, presents a perpetual challenge for policymakers seeking to maintain employment levels and skill development within the workforce. The reader should understand that this isn’t a simple case of replacing one worker with another; it often involves a complete redefinition of the skillset required for industrial employment.

European industrial spine failure is a critical issue that has garnered attention in recent years, particularly in the context of infrastructure resilience and sustainability. For a deeper understanding of the challenges and potential solutions related to this topic, you can refer to a related article on the subject at My Geo Quest. This resource provides valuable insights into the factors contributing to industrial spine failures and discusses innovative approaches to mitigate these risks across Europe.

The Regulatory Labyrinth and High Operational Costs

Europe’s commitment to environmental protection, workers’ rights, and social welfare, while laudable, has inadvertently created a challenging environment for its industrial sector when compared to other global manufacturing centers. This framework, often perceived as a “regulatory labyrinth,” contributes to higher operational costs, sometimes making European production less competitive.

Environmental Standards and Compliance

European Union environmental standards are among the most stringent in the world. While these regulations are essential for combating climate change and protecting public health, they impose significant compliance costs on manufacturers. Investments in emission reduction technologies, waste management systems, and sustainable production processes are substantial.

Consider, for instance, the steel industry. European steel producers face rigorous emissions targets and energy efficiency requirements that necessitate considerable capital expenditure. While these investments yield environmental benefits, they also contribute to higher production costs compared to producers in regions with more lenient regulatory frameworks. This disparity can make it difficult for European companies to compete on price in global markets, compelling some to relocate or reduce output.

Labor Costs and Social Welfare Contributions

Another significant factor contributing to high operational costs in Europe is the combination of high labor costs and extensive social welfare contributions. European workers generally enjoy higher wages, comprehensive healthcare, robust pension schemes, and generous leave entitlements, which are funded through employer contributions.

While these provisions are cornerstones of the European social model and contribute to a high quality of life, they translate into significantly higher labor costs per hour compared to many other manufacturing regions. For industries that are highly labor-intensive, this disparity can be a decisive factor in investment decisions, often deterring new manufacturing facilities from being established in Europe or encouraging existing ones to seek more cost-effective locations. The reader should appreciate the inherent trade-off: a strong social safety net comes with a quantifiable economic cost for businesses.

The Brain Drain and Skills Gap

The decline in traditional manufacturing has created a ripple effect, contributing to a “brain drain” and a widening skills gap within the European workforce. As industrial opportunities diminish, talented individuals may look elsewhere for career prospects, and fewer young people may choose vocational paths traditionally associated with manufacturing.

Exodus of Skilled Labor

When factories close or significantly downsize, the highly skilled workers who once formed their backbone are often left in a precarious position. While some may retrain, many find their specialized skills no longer in high demand within Europe. This can lead to an exodus of skilled labor, as these individuals seek opportunities in countries with thriving industrial sectors.

This phenomenon is particularly acute in specific regions or countries historically reliant on heavy industry. The loss of experienced engineers, technicians, and specialized craftspeople represents not just individual economic hardship but also a broader depletion of national human capital. The reader might see this as the erosion of tribal knowledge within industries, difficult to rebuild once lost.

Disincentives for Vocational Training

With the perceived decline of traditional manufacturing as a viable and lucrative career path, fewer young people are opting for vocational training and apprenticeships in these sectors. The allure of white-collar professions or emerging digital industries often eclipses the practical, hands-on trades that were once highly valued.

This creates a dangerous cycle: as older, experienced workers retire, there are fewer new entrants to replace them, exacerbating the skills gap. Industries that still require these specialized skills struggle to find qualified personnel, further hindering their ability to operate efficiently and innovate. This is a subtle yet powerful form of erosion, as the future pipeline of talent is being diverted.

Energy Costs and Geopolitical Instability

Recent years have underscored the vulnerability of Europe’s industrial sector to fluctuations in global energy markets and geopolitical events. The continent’s reliance on imported energy sources, particularly for natural gas, has proven to be a critical dependency, capable of significantly impacting production costs and stability.

The Energy Crisis and Its Aftermath

The energy crisis of 2022, triggered by geopolitical events, sent shockwaves through European industry. Unprecedented spikes in natural gas and electricity prices rendered many energy-intensive manufacturing processes economically unviable. Factories across various sectors, from chemicals to steel to fertilizers, were forced to curtail production, implement temporary shutdowns, or even consider permanent closures.

This crisis laid bare the fragility of Europe’s industrial energy supply chain. While some industrial sectors have adapted by investing in greater energy efficiency or transitioning to alternative fuels, the fundamental vulnerability remains. Manufacturers continue to grapple with higher, more volatile energy costs compared to competitors in regions with abundant and cheaper domestic energy resources. The reader should consider this a structural disadvantage that demands a comprehensive strategic response.

Geopolitical Supply Chain Disruptions

Beyond energy, geopolitical instability has also highlighted the fragility of global supply chains upon which European industry increasingly relies. Events such as the COVID-19 pandemic and regional conflicts have exposed critical dependencies on specific components or raw materials produced in distant, potentially unstable, regions.

Disruptions in these supply chains can lead to production delays, increased costs, and ultimately, a reduced capacity for European manufacturers to deliver goods efficiently. This has prompted a renewed focus on “reshoring” or “friend-shoring” production, but such transitions are costly, complex, and cannot be implemented rapidly. The interconnectedness of modern industry, while offering efficiencies, also creates points of vulnerability that geopolitical events can exploit, acting as a corrosive agent on sustained industrial output.

European industrial spine failure is a critical issue that has garnered attention in recent years, particularly in the context of infrastructure resilience and maintenance. For a deeper understanding of the challenges and solutions surrounding this topic, you can explore a related article that delves into the implications of such failures on the economy and safety standards. This insightful piece can be found here, offering valuable perspectives on the necessary measures to prevent future incidents and enhance industrial robustness across Europe.

The Path Forward: Adaptation or Irrelevance?

| Metric | Value | Unit | Notes |

|---|---|---|---|

| Number of Industrial Spine Failures (2023) | 27 | Incidents | Reported across major European industrial hubs |

| Average Downtime per Failure | 14 | Days | Time taken to restore full operational capacity |

| Economic Impact | 1.2 | Billion Euros | Estimated loss due to production halts and repairs |

| Primary Cause | Material Fatigue | N/A | Leading cause of spine structural failure |

| Percentage of Failures Due to Design Flaws | 35 | % | Failures attributed to engineering and design issues |

| Average Age of Equipment at Failure | 12 | Years | Age of industrial spine components when failure occurred |

| Preventive Maintenance Compliance Rate | 78 | % | Percentage of facilities adhering to recommended maintenance schedules |

The challenges facing Europe’s industrial backbone are profound and multifaceted. However, the narrative is not solely one of decline. Many policymakers and industry leaders are actively seeking solutions, aiming to adapt Europe’s industrial landscape rather than concede to its irrelevance. This involves strategic investments, innovation, and a re-evaluation of industrial policy.

Strategic Investment in Green Technologies

One of the most significant avenues for regeneration lies in Europe’s ambitious push towards green technologies and a circular economy. The continent aims to become a leader in renewable energy production, electric vehicle manufacturing, sustainable materials, and carbon capture technologies. This shift represents a potential new frontier for industrial growth, leveraging Europe’s strong research and development capabilities and its commitment to environmental stewardship.

Public and private investments are being channeled into these sectors, with the hope that Europe can carve out new niches of global industrial leadership. The reader should see this as an attempt to transform a perceived weakness (stringent environmental regulations) into a competitive advantage, fostering industries that align with future global demands. This is not merely about maintaining industrial output but reinventing it.

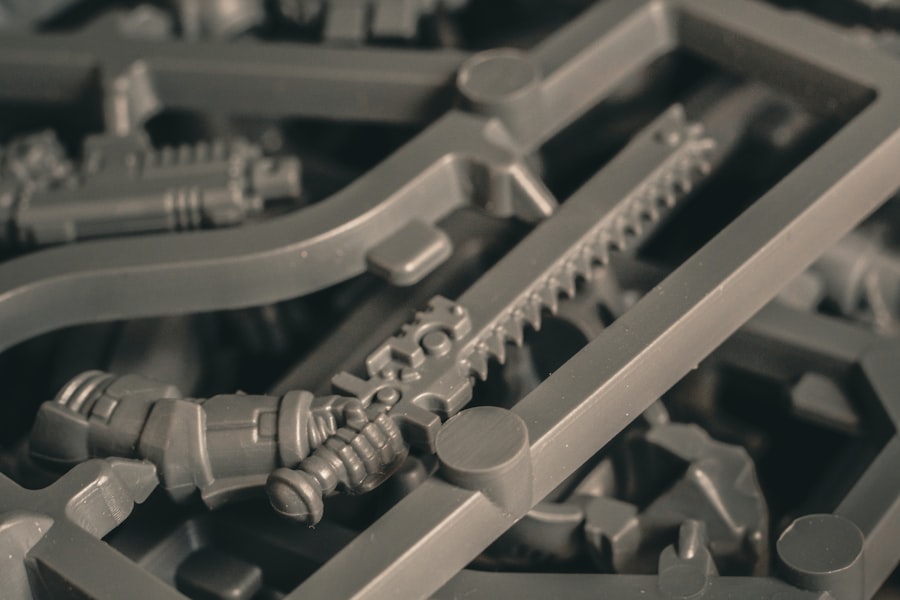

Fostering Innovation and High-Tech Manufacturing

While traditional manufacturing may face headwinds, Europe retains significant strengths in high-tech, specialized, and precision manufacturing. Industries such as pharmaceuticals, advanced machinery, aerospace, and luxury goods continue to thrive, often relying on highly skilled labor and cutting-edge research.

The focus is increasingly on nurturing these high-value sectors, promoting innovation through R&D investment, and ensuring a pipeline of talent with the necessary advanced skills. This also includes embracing Industry 4.0 concepts – the integration of digital technologies, artificial intelligence, and automation into manufacturing processes – to enhance productivity and competitiveness. The strategy is to move up the value chain, focusing on products and services where intellectual property and advanced capabilities provide a defensible competitive edge, rather than competing solely on labor costs.

Re-evaluating Industrial Policy and Trade Strategy

Finally, there is a growing recognition that Europe needs to re-evaluate its industrial policy and trade strategy to better protect and promote its manufacturing base. This includes exploring mechanisms to level the playing field against competitors with less stringent regulations, potentially through carbon border adjustment mechanisms or more robust anti-dumping measures.

Furthermore, discussions are underway regarding the need to diversify supply chains, reduce critical dependencies, and foster greater domestic or regional sourcing for essential goods and raw materials. This strategic recalibration aims to bolster resilience and ensure that Europe’s industrial sector can withstand future shocks. The reader should understand that this is a long-term undertaking, akin to steering a supertanker: changing direction requires immense effort and time, but it is deemed essential for sustained prosperity and strategic autonomy. The narrative around the “collapse” of Europe’s industrial backbone is not a story without hope, but one that demands a proactive and intelligent response to an evolving global landscape.

FAQs

What is European industrial spine failure?

European industrial spine failure refers to the decline or weakening of key industrial sectors in Europe that have traditionally formed the backbone of the continent’s economy. This can involve the collapse or significant reduction in manufacturing, heavy industry, and related infrastructure.

What are the main causes of industrial spine failure in Europe?

The main causes include globalization leading to competition from lower-cost countries, technological changes reducing the need for traditional manufacturing jobs, shifts in economic focus towards services, and sometimes inadequate investment in modernization and innovation.

Which industries are most affected by the European industrial spine failure?

Industries most affected typically include steel production, coal mining, shipbuilding, and heavy machinery manufacturing. These sectors have seen significant job losses and plant closures in various European regions.

What are the economic consequences of industrial spine failure in Europe?

Consequences include increased unemployment in affected regions, economic decline in industrial towns, reduced export capacity, and challenges in maintaining social cohesion. It can also lead to a loss of technical skills and industrial expertise.

What measures are being taken to address industrial spine failure in Europe?

Measures include government and EU initiatives to promote industrial innovation, investment in new technologies such as green energy and digital manufacturing, retraining programs for workers, and policies aimed at revitalizing affected regions through economic diversification.